The smart Trick of Bank Statement That Nobody is Talking About

Wiki Article

The Only Guide to Bank Account Number

Table of ContentsThe Ultimate Guide To Bank Code9 Easy Facts About Bank Definition ShownOur Bank Certificate IdeasThe smart Trick of Bank Code That Nobody is Talking About

You can additionally conserve your money and earn passion on your investment. The cash saved in most bank accounts is government guaranteed by the Federal Down Payment Insurance Coverage Company (FDIC), up to a limit of $250,000 for private depositors and also $500,000 for collectively held down payments. Banks also give credit report opportunities for individuals and also corporations.

Banks make a profit by charging even more interest to debtors than they pay on interest-bearing accounts. A financial institution's size is figured out by where it is located and also who it servesfrom small, community-based institutions to huge commercial banks. According to the FDIC, there were simply over 4,200 FDIC-insured commercial financial institutions in the USA since 2021.

Standard financial institutions offer both a brick-and-mortar place as well as an on-line presence, a new pattern in online-only banks arised in the very early 2010s. These banks commonly offer customers greater passion rates and lower costs. Convenience, rate of interest prices, and charges are several of the factors that help consumers choose their liked financial institutions.

10 Simple Techniques For Bank Reconciliation

The governing atmosphere for financial institutions has actually because tightened up considerably as an outcome. U.S. banks are controlled at a state or national level. State banks are regulated by a state's department of financial or department of economic institutions.

You ought to consider whether you desire to maintain both company and also individual accounts at the same financial institution, or whether you want them at different banks. A retail financial institution, which has fundamental banking solutions for consumers, is the most ideal for daily banking. You can pick a conventional financial institution, which has a physical structure, or an on the internet bank if you don't want or require to physically go to a financial institution branch.

, for example, takes deposits as well bank foreclosed properties 2022 as provides locally, which can supply a much more personalized financial partnership. Pick a hassle-free place if you are choosing a bank with a brick-and-mortar place.

The 10-Second Trick For Bank Account Number

Some financial institutions additionally supply smartphone applications, which can be useful. Some huge banks are moving to end over-limit charges in 2022, so that could be a vital factor to consider.Finance & Growth, March 2012, Vol (bank account). 49, No. 1 Organizations that compare savers and also consumers aid guarantee that economic situations function smoothly YOU'VE obtained $1,000 you do not require for, claim, a year and also want to make earnings from the cash until after that. Or you desire to purchase a residence and need to obtain $100,000 and also pay it back over thirty years.

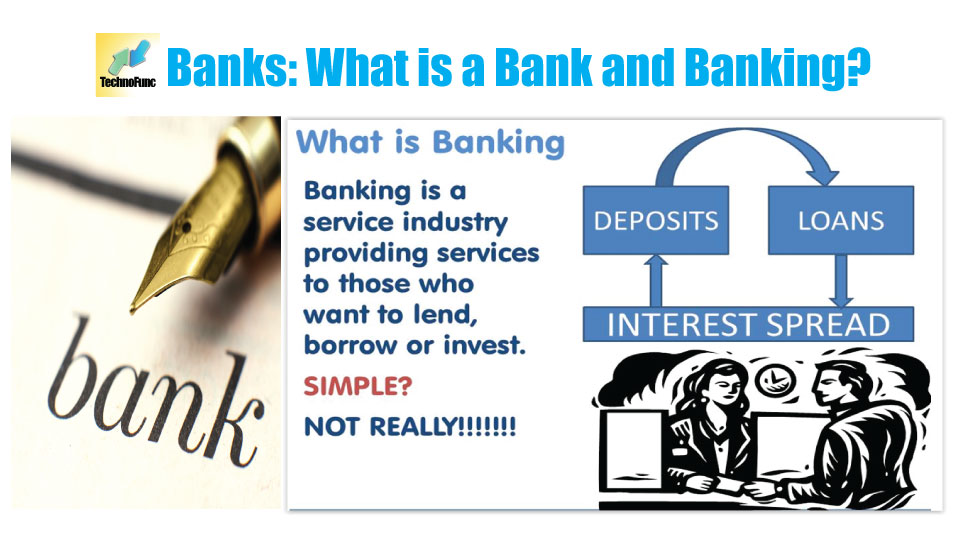

That's where banks are available in. Banks do lots of points, their primary function is to take in fundscalled depositsfrom those with cash, swimming pool them, and also offer them to those that require funds. Banks are intermediaries between depositors (who lend money to the financial institution) and also borrowers (to find out whom the bank lends money).

Deposits can be available on demand (a monitoring account, for instance) or with some constraints (such as financial savings and also time down payments). While at any type of provided minute some depositors need their money, most do not.

Bank Statement Fundamentals Explained

The process includes maturation transformationconverting short-term liabilities (down payments) to lasting assets (loans). Banks pay depositors much less than they receive from customers, and also that difference accounts for the bulk of financial institutions' revenue in a lot of nations. Banks can match conventional down payments as a resource of financing by straight borrowing in the money as well as funding markets.

Banks maintain those called for gets on deposit with central financial institutions, such as the U.S. Federal Book, the Financial Institution of Japan, and the European Reserve Bank. Banks develop cash when they lend the remainder of the money depositors provide them. This cash can be made use of to buy products as well as services as well as can discover its way back into the banking system as a deposit in one more bank, which then can provide a fraction of it.

The size of the multiplierthe amount of money created from an initial depositdepends on the quantity of cash financial institutions must go on reserve (bank certificate). Financial institutions additionally lend and reuse excess cash within the financial system and also develop, disperse, and also profession protections. Financial institutions have a number of ways of making cash besides filching the distinction (or spread) between the interest they pay on down payments and also obtained cash and also the rate of interest they collect from debtors or safeties they hold.

Report this wiki page